Trend indikators

Moving Averages (Moving Average, or

removals).

The idea of an indicator lies in the

fact that random fluctuations in the price is hampered understand

where the market is moving. Therefore, the formula for calculating

the indicator suggests smoothing of these oscillations.

Simple Moving Average (Simple Moving

Average - SMA):

SMA = (P1 + P2 + P3 +??.+ Pn) / n

P = Price - regular price. Typically, the price calculation using

the closing price (Close).

n - the period (the window, order, length) moving average. This is

the number of bars on which the indicator is calculated.

The main drawback of SMA is that it responds to a single change

course twice: when getting the value and at its disposal from the

calculation. Therefore, we can use more advanced options display.

Weighted averages (Weighted Moving

Average - WMA):

WMA = (w1 * P1 + w2 * P2 + w3 * P3

+??.+ wn * Pn) / (w1 + w2 + w3 +?? + Wn)

wi - the so-called "weight" or simply, the coefficient, which is

assigned to each price. The closer the price to date, the higher the

ratio is assigned a price.

Exponential moving average

(Exponentially Moving Average - EMA):

EMA (t) = EMA (t - 1) + (K x [Price (t)

- EMA (t - 1)]

where t - current time (current bar)

t - 1 - previous time (the previous bar)

K = 2 / (n + 1)

n - period average.

The main advantage of EMA is that it

includes all the prices of the previous period, and not just the

segment specified in the installation period. In this case, the

later values will have greater weight.

Length Movings correct to select a specific tool in which you trade,

and a specific scale of the graph.

Some traders believe that it is best to use the numbers from the

Fibonacci series.

For example, the following values.

Recommended order of the average

Order of the average price chart

5-day 8, 13, 21

1-day 8, 13, 21, 55, 89

4-hour 8, 34, 55, 89

1-hour 8, 34, 55, 89

<15 min. 34, 55, 144

Using the indicator:

Point of intersection of Moving Average and the price chart is used as signals of the position opening in the direction of the trend. Inverse intersection are used as signals for closing the position.

In the first method is often a false signals, since markets are becoming every year more and more mobile. Therefore, as a signal using the intersection point of two Moving Average of different lengths (n1 and n2);

Moving Average of great length can themselves be pointers trend. For values of indicators over 40, they have little reaction to the wave motion graphics and indicate only the general direction of movement (trend);

The point of greatest divergence of average and

the price chart indicates that the market is strongly "overheated

and a correction.

Moving averages work well in trending markets, and very bad at

without trending

(flat), since the delay of moving averages will produce false

alarms.

Alligator (alligator)

Based on moving averages Bill Williams (full

exposition of the theory of Williams, see Williams' Chaos Theory)

proposed by this indicator, which consists of three lines:

The blue line (Alligator's Jaw)

- is the Balance Line for the interim period, which was used for

plotting (13-period Smoothed Moving Average, moved into 8 bars into

the future);

The red line (Alligator's Teeth)

- is the Balance Line for a significant time

period is ten times lower (8-period Smoothed Moving Average, moved

by 5 bars into the future);

The green line (Alligator's Lips)

- is the Balance Line for a significant time period, which is lower

by one order of magnitude (5-period Smoothed Moving Average, moved

by 3 bars into the future).

All these lines are on average prices:

MEDIAN PRICE = (HIGH + LOW) / 2

With the Alligator can determine the direction of an existing trend

or its absence.

If all three lines are intertwined, the Alligator "asleep". At this

time, the market traded in a little price range (in the flat),

selecting the trader earned on past price movement. The longer

sleeping Alligator, the hungrier it becomes and the stronger will be

the subsequent price movement. While the Alligator is asleep, stay

square. Waking up, Alligator opens mouth (Balance lines diverge) and

starts to hunt for prey.

After eating, alligator back to sleep (Balance Lines

converge).

If the alligator is not sleeping, the

market is bullish or bearish trend (production runs from Alligator):

• 1. if the price is above the Alligator's mouth,

then the trend is upward;

• 2. if the price is below the Alligator's mouth, the trend is

downward.

Ichimoku Kinko Hyo

A very popular indicator created as based on

moving averages. Indicator Ishimoku create a Japanese analyst Hosoda

(alias Sanzhdin Ishimoku).

The indicator consists of five lines:

• Tenkan-sen

- the average price for the first time

interval (equal (high low) / 2, where the high and low - high and

low for the period);

• Kijun-sen

- the average price in the second period;

• Senkou Span A

/ Up Kumo

- midway between Tenkan-sen and Kijun-sen, shifted forward on value

of the second time interval;

• Senkou Span B

/ Down Kumo

- the average price for the third time interval shifted forwards by

the value of the second time interval;

• Chinkou Span

- the closing price of the current bar, shifted back on the amount

the second time interval.

Line Senkou Span A and Senkou Span B form a "cloud", which changes

color when the intersection of these lines.

If the price chart located above the cloud, then the trend is

upward. If the price chart below the cloud, then the market bearish

sentiment. If prices are in the "cloud", it says fletovom market.

Line motion Tenkan-sen sideways also talks about flat.

Key indicator signals:

Output prices from the cloud down to signal to sell up - on

purchase.

Often, coming out of the clouds, the price of

doing the path

approximately equal to the path up to the clouds.

The intersection of price and Chinkou Span (green line) is a signal to the transaction. If Chinkou Span crosses the price upwards, it is a buy signal, from top to bottom - for sale

If Tenkan-sen (red line) crosses Kijun-sen (blue line) from the top down, formed a sell signal, from the bottom up - by purchase

When trading in a "cloud" the price tends to the boundary of the clouds, to indicate Tenkan-sen (red line). If Tenkan-sen is directed downward, the price tends to cloud base if up - to the top

price channel upper - pcu

Or envelope

.

Two names for one indicator.

Because the market tends to speed up and slow down, draw

straight lines of support and resistance is quite difficult.

The indicator will build a flexible channel that responds to

changes in the rate of the market.

It is constructed on the basis of a simple moving average,

which moves up and down on a certain amount per cent, so

that most of the price fluctuation was within the lines.

Upper limit:

U = (1 + u / 100) x SMA (P, n);

Lower Bound:

L = (1 - d / 100) x SMA (P, n), where

U - upper band channel prices

L - lower band channel prices

u -% deviation from the average of the upper band,

d -% deviation from the average of the lower band,

SMA (P, n) - simple moving average.

If successful, the choice of parameters channel will

correspond to the equilibrium state of the market, and all

exits prices beyond it must be accompanied by the return of

her back.

About 5% of the price should be outside the lines, 95% -

within.

Convergence Divergence Moving Average (macd)

In the indicator is calculated and

constructed two lines:

MACDfast - fast line

SIGNAL - Signal (slow) line

Of the exponential average with a

smaller period (12) is subtracted exponential moving average

with a long period (26)

MACDfast = EMA (1912) [Price] - EMA (1926) [Price];

and the results are again smoothed using EMA to eliminate

random fluctuations:

SIGNAL = EMA (9) [MACDfast],

where Price - the price is usually Close.

Signals MACD:

• If

the MACD is below zero, the trend is downward, if the above

- is upward;

• The strongest signal for this indicator is the divergence

(Divergence). Divergence - a discrepancy in the direction of

the waves

graph and the corresponding waves

indicator. He warns of the imminent

reversal of the market;

Signal bullish trend reversal or attenuation

Turn signal bearish trend or its decay

• The intersection of the lines of the indicator

in the trend can be used as signals for open positions.

• If the MACD is below zero and there is no divergence, then the

suppression of the lines from the bottom up talking about correcting

upwards.

• If the MACD is above zero and there is no divergence, then the

suppression of the lines from top to bottom indicates downward

correction.

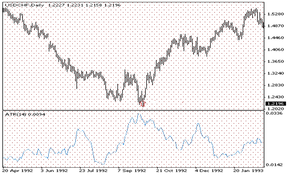

Average True Range (ATR) - a measure of the volatility of the market, developed and described by W. Wilder in his book "New Concepts in Technical Trading Systems."

True Range is the greatest of the following three values:

• the difference between the maximum and minimum of the current bar;

• the difference between the closing price the previous period and the maximum of the current bar;

• the difference between the closing price the previous period and the minimum price the current bar.

Indicator Average True Range (ATR) is a moving average of true range.

The basic rule

analysis of the oscillator:

The higher the indicator value, the

higher the probability trend change;

the lower the value, the weaker the trend.

Parabolic (ptp)

Originally developed as an indicator

of automatic installation of Stop Loss (Stop Order) and a

coup position when the motion.

And she called Stop And

Reverse system - SAR. However, it turned out that the system

itself can be a good indicator.

In the indicator values are

calculated stops depending on the degree of progress in the

direction of the market trend. The greater the progress, the

closer the point indicator (stop loss) to the current value

prices.

SAR (i) = AF * (High (i-1) - SAR (i-1)) SAR (i-1) - when the

market rises;

SAR (i) = AF * (Low (i-1) - SAR (i-1)) SAR (i-1) - when the

market moves down;

where

SAR (i-1) - meaning parabolika on the

previous bar;

AF (Acceleration Factor) - the acceleration factor.

At the first bar, he is taken to be 0.02, and then

calculated as follows:

AF = 0,02 n * 0,02,

where n-number of new bars.

Parabolic signals:

Using the indicator is very simple and visual -

Direction of movement of the indicator coincides with the

direction of the trend.

Classical signal to open a position

- the intersection of the line graph line indicator.

Indicators of "directed change" (+ /-dm) the probable direction of (adx)

The indicator has two roles:

• 1. identifies

long-term trend of the market;

• 2. shows the power of the trend.

The indicator is constructed as two

mutually antithetical lines /-DM and lines ADX:

• 1. first goes in the

direction of price movement (line 1, DM);

• 2. second - in the

opposite direction (line 2,-DM);

• 3. third (ADX) is absolute (in absolute value) difference between

the lines /-DM, so the more lines of difference /-DM, the greater

the value of ADX.

Signals Indicator Average Directional Movement

Index (ADX):

• 1. intersection with the lines of extreme

or spread lines at the maximum-minimum;

• 2. intersection of the

lines DM and-DM is preceded by the appearance of a new trend or

enhance the current trends - a very strong signal;

• 3. If the line above the DM-DM, then the trend

- bullish, and vice versa;

• 4. if the lines diverge, the ADX rises, and the dynamics of the

trend increases, and vice versa;

• 5. If the ADX is less than 20, the trend is very weak.

Relative strenght index – rsi

This is one of the most popular implementations of

oscillators.

RSI = 100 - (100 / (1 U / D))

where

Un - the average of all UpClose period indicator calculation (n).

Dn - the average of all DownClose over the same period.

Basic signals for RSI:

• If the value is above 50, the upward trend in the market, if

lower, then descending;

• Divergence (divergence) between the direction of wave motion

graphics, and the indicator indicates the weakness of the current

trend and a possible reversal;

• In a flat market output indicator from the overbought (oversold)

is a signal to sell (purchase);

• In addition, it is one of the few indicators that are well suited

to graphical analysis tools: support and resistance lines, graphic

shapes.

Relative vigor index, rvi

Calculation of the index of

relative vigor based on the idea that the upward market closing

price, usually higher than the opening price. And in a bear market

closing prices are usually lower opening prices.

To normalize the index change in price divided by the maximum range

of prices for a bar:

RVI = (CLOSE - OPEN) / (HIGH - LOW)

Where:

OPEN - open price;

HIGH - the highest price;

LOW - the lowest price;

CLOSE - the closing price.

To eliminate the random fluctuations in price oscillator smoothed

simple moving average with period 10. We also construct a signal

line, 4-period symmetrically weighted moving average of the

indicator.

Key signals Relative

Vigor Index:

• Bullish

divergence / bearish convergence - the main signal, indicating the

weakness of the current trend;

• a good moment to open a position on the sale (purchase) will be

crossing the line RVI signal line downwards (upwards) after the

appearance of the chart bullish divergence / bearish convergence;

• In a flat market exit from the overbought (oversold)-signal to

sell (buy).

Standard deviation

Measures the volatility of the market. This

indicator describes the size of price fluctuations relative to the

moving average. For example, if the indicator value is large, the

market is volatile and the price bars are rather scattered with

respect to moving average. If the indicator value is low, the market

is characterized by low volatility and the price bars are close

enough to the moving average.

Normally, this indicator is used as a component of other indicators.

Thus, when calculating Bollinger Bands of the standard deviation of

the tool is added to its moving average.

Calculation

StdDev (i) = SQRT (AMOUNT (j = i - N, i) / N)

AMOUNT (j = i - N, i) = SUM ((ApPRICE (j) - MA (ApPRICE (i), N, i))

^ 2)

where:

StdDev (i) - Standard Deviation of the

current bar;

SQRT - square root;

AMOUNT (j = i - N, i) - sum of the squares

of the j = i - N to i;

N - smoothing period;

ApPRICE (j) - applied price of the j-th bar;

MA (ApPRICE (i), N, i) - any Moving Average

of the current bar for N period;

ApPRICE (i) - applied price of the current bar.

The dynamics of the market consists of the

successive alternation of periods of rest and activity bursts, so

the approach to this indicator is simple:

• If the indicator value is too small, then there is a market in

complete peace, it makes sense to expect a quick burst of activity;

• Conversely, if the indicator is extremely high, therefore, likely

that activity will soon start declining

The index

of trade channel

Indicator rasschityvetsya in several stages.

1) Calculate the so-called typical price

TP = (High + Low + Close) / 3

2) Further, the TP value is subtracted simple moving average

calculated from the values of TP

D = TP - SMA (TP, n)

3) The value

of a simple moving average calculated from the values of D is

multiplied by 0.015

M = SMA (D. n) * 0,015

4) The final value of the indicator

CCI = M / D

Basic signals for CCI:

• Divergence (divergence) between the

direction of wave motion graphics, and the indicator indicates the

possibility of corrective movements;

• In a flat market output indicator from the overbought (oversold)

is a signal to sell (purchase).

Stochastic

line

The purpose of Stochastics - identifying price trends and cornering

by monitoring the placement of the closing prices in the last series

of peaks and bottoms.

The method of

monitoring the following fact: when prices rise, their daily closing

levels tend to be closer to the value of the maximum.

If prices continue to rise, and the daily closing prices

begin to fall, it signals the willingness of trend turn.

When prices fall, all the same only for the minima.

There are three stochastic lines:% K,% D,% R.

They reflect the location of the current closing

price relative to the selected time period.

% K = 100 ((C - Ln) / (Hn - Ln))

where

C - current closing price

Ln - lowest Low over the last n bars chart

Hn - is the highest High over the last n bars.

% D = SMA (% D, n1)

n1 - the value of a simple moving average.

Basic signals for Stochastic:

• Initially, the indicator was created to trade in the market in a

state of a flat market. But now the trend movement using divergence

(divergence) between the direction of wave motion graphics and

display as a signal of a possible reversal or correction;

• In a flat market output indicator from the overbought (oversold)

is a signal to sell (purchase);

• If the faster% K line crosses the slower% D up,

it's a buy signal. If the faster% K line

crosses the slower% D down, this is a signal to sell.

Concluding remarks

When working on a strong trend to treat oscillator signals with the

utmost care, while false signals oscillators tend to talk about

strengthening trend.

If the trend is upward, then most of the time oscillators are

overbought, if the opposite is in oversold territory

Performance

measures

Basic rules:

• Lower the volume - reduction of interest in the dynamics of the

course or change in trend or a temporary stabilization of prices.

• Increased volume - increasing interest in the dynamics of the

course, or reinforce existing dynamics, or the emergence of a new

direction of price change.

• Sometimes a gradual decline in prices accompanied by drastic

changes.

• Peak volume signals a possible trend reversal.

Indicator of the equilibrium volume (On Balance Volume - OBV)

1) If C (i)> C (i - 1),

OBV (i) = OBV (i-1) + Volume (i)

2) If C (i) <C (i -

1),

OBV (i) = OBV (i-1) - Volume (i)

where

C (i) - Current Close;

C (i - 1) - Close the previous bar;

Volume (i) - tekschee value of trading volume.

Accumulation / distribution (a

/ d)

A / D = SUM

(((Close - Low) - (High - Close)) * Volume / (High - Low), N)

This indicator is the complicated version of the indicator OBV, so

the method works with exactly the same.

Major signals for

the A / D:

• If each new

peak price confirmed by a new peak indicator, then this confirms the

force of a bull (rising) trend;

• If each new trough price confirmed a new indicator of depression,

then this confirms the force of a bear (downward) trend;

• Divergence (divergence) between the direction

of wave motion graphics, and the indicator indicates the weakness of

the current trend and a possible reversal;

• Break the trend line, built on the indicator warns of imminent

breakdown of the trend line on a chart.

• The main signals for Force Index:

• The main signal - Divergence (divergence) between the direction of

wave motion graphics and display. Indicates the possibility of a

reversal of the market.

Index of cash flow ( mfi)

The indicator is calculated in several steps.

1) Calculate

the so-called typical price:

TP = (High + Low + Close) / 3

2) If C> C (-1), the calculated + MF = TP * Volume

If C <(-1), then calculated - MF = TP * Volume

On this basis, calculated a positive cash flow (Positive Money

Flow):

PMF =? (+ MF) - the sum of all + MF for n-bars.

And negative cash flow (Negative Money Flow):

PMF =? (-MF) - the sum of all-MF for n-bars.

3) Next, calculate the ratio of cash (Money Ratio):

MR = PMF / PMF

4). And the final value of the indicator (Money Flow Index):

MFI = 100 - (100 / (1 + MR)

where

C - Current Close;

C (-1) - Close the previous bar;

Volume - the value of trading volume for the current bar.

Major signals for the MFI:

• If each new

peak price confirmed by a new peak indicator, then this confirms the

force of a bull (rising) trend;

• If each new trough price confirmed a new indicator of depression,

then this confirms the force of a bear (downward) trend;

• Divergence (divergence) between the direction

of wave motion graphics, and the indicator indicates the weakness of

the current trend and a possible reversal.

Index to facilitate the market

( bw mfi)

The indicator is calculated by the formula:

BW MFI = (HIGH - LOW) / VOLUME

Where:

HIGH - the

highest price of the current bar; LOW - the lowest price of the

current bar; VOLUME - the volume of the current bar.

Signals:

• Simultaneous

growth of BW MFI and volume (Volume) says that more and more players

enter the market (increasing volume), and new players take positions

in the direction of the bar.

• The simultaneous drop in BW MFI and volume of talk about reducing

the interest of participants to the dynamics of the price.

• BW MFI rose, and the volume down - the market does not support

such a dynamic price. Price Change - the result

of speculation.

BW MFI fell, and the volume increased - a

fierce battle between bulls and bears (the amount raised), but the

forces are roughly equal (the indicator has fallen). This bar B.

Williams "curtsying. Typically, a breakthrough of such a bar is very

important in terms of future price movement.