IntroductionTechnical analysis - the study of market dynamics, often by means of charts, to forecast the future direction of price movement.We formulate three postulates, which, as the three pillars, "is" technical analysis:1. Price (rate) takes into account all

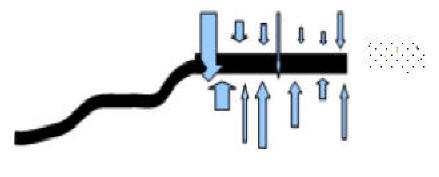

At each time the price effect, a large number (fundamental) factors.

Some of them are "pressured" by the price up, others down.Price and factors acting on it

Factors of tens and perhaps hundreds. And they all have different meanings, different "weight" and a different meaning in the eyes of market participants .... But the price is influenced by all these factors have shown a certain value. That is the price at a time already "took into account" all factors that have already responded to them! Therefore, technical analysts believe that the correctness of the chosen object of analysis, not all are difficult to even accounting fundamentals, as a result of their influence - the price chart.

2. Price movement is subject to trends (trend)

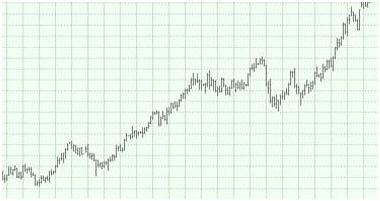

Trend is the main direction of price movement. The main objective of the trader - is to identify the trend as early as possible and trade in the direction of its motion.3. There are three types of trend

Ascendant - the price goes up. This trend is historically referred to as "bychim"

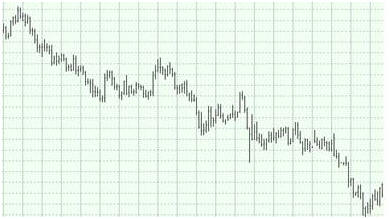

The downstream - the price goes down. This trend is historically referred to as "bearish"

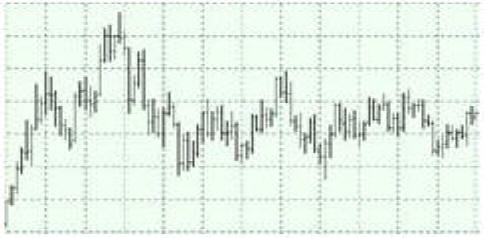

Side - the price fluctuates up and down without creating a sustainable movement. This type of trend is called flat, whipsaw, range

Dow Theory

Initially, the principles set out in Charles Dow, were used for the analysis he created the U.S. indexes, industrial and railway. But with the same success, most analytical conclusions Dow can be applied in the financial markets.

Main provisions of the Dow Theory:

1. Index takes into account everything. According to Dow theory, any factor that can somehow affect the supply or demand, always will be reflected in the dynamics of the index. Of course, these events are not predictable, however, they are immediately taken into account by the market and affect the dynamics of the indices.

2. In the market there are three types of trends. With the rising trend each successive peak and each subsequent decline over the previous. If the downward trend each subsequent peak and decline is lower than the previous one. When a horizontal trend each subsequent peak and decline is about the same level as the previous ones.

Dow also distinguished three categories of trends: primary, secondary and minor. The greatest value he attached to it a primary or major trend that has lasted more than a year, sometimes for several years. Secondary or intermediate trend correction is relative to the main trends and usually lasts from three weeks to three months. These interim amendments ranged from one to two-thirds (often half) of the distance traveled by the prices during the previous (major) trend. Small or short-term trends do not last more than three weeks and are a short-term fluctuations in the intermediate trend.

3. The main trend has three phases. Phase One, or the accumulation phase, when the most visionary and knowledgeable investors begin to fly, since all the poor economic information has already been taken into account by the market. The second phase occurs when the game includes those who use the techniques of following trends. Economic data is becoming more optimistic. Trend is in its third or final phase, when the action takes the general public and the market begins hype, fueled by the media. Economic forecasts are optimistic. Increases the amount of speculation. Here there are informed investors who have "accumulated" during the decline of the previous trend, when no one wanted to "accumulate" and start to "distribute". Trends come to an end.

4. Indices must confirm each other. Here Dow was referring to the industrial and railway indexes. He believed that any important signal to increase or decrease in rate in the market must pass in the values of both indexes.

5. The volume of trade must confirm a trend. Volume should increase towards the main trend.

6. Trend only lasts as long as there has not filed an obvious signal that she has changed.

| Welcome Guest | RSS | Thursday 05.02.2026, 07:21 | ||

| Forex Basic Information |

|

|